|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

FHA Refinance Bad Credit: Understanding Key Features and HighlightsRefinancing a mortgage can be a beneficial financial strategy, especially for individuals with less-than-perfect credit. An FHA refinance for bad credit is one option that offers flexibility and potential savings. In this article, we'll explore the main benefits and considerations of FHA refinancing. What is FHA Refinance?The Federal Housing Administration (FHA) provides refinancing options designed to help homeowners with bad credit. These loans are insured by the FHA, which allows lenders to offer more favorable terms. Key Benefits of FHA Refinancing

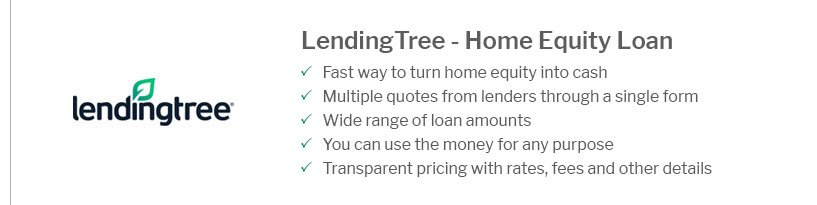

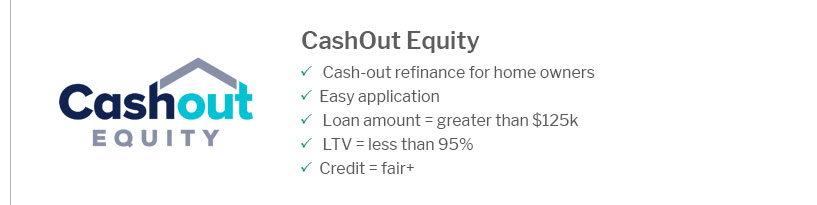

Types of FHA Refinance LoansFHA Streamline RefinanceThis option is available to homeowners with existing FHA loans. It aims to lower monthly payments and interest rates with minimal documentation. Cash-Out RefinanceFor those looking to access their home's equity, an FHA cash-out refinance allows you to take out a new loan that is larger than your existing one, with the difference provided to you as cash. This can be particularly useful when considering investments or dealing with emergencies. For more information on current rates, visit home equity line of credit rates. Considerations Before Refinancing

Comparison with Other Mortgage RatesWhen exploring refinancing options, it's essential to compare them with other available rates. For instance, 15 year fixed mortgage rates today might offer an appealing alternative depending on your financial situation and goals. Frequently Asked Questions

https://www.fha.com/fha_article?id=3207

Refinancing a mortgage is a great option for borrowers who want to refinance into a lower interest rate or monthly payment. Streamline refinance loans allow FHA ... https://riverbankfinance.com/mortgage-programs/bad-credit-fha-mortgage.html

Bad Credit FHA Mortgage Loans are mortgage options that allow you to buy a home or refinance your current mortgage with less than perfect credit. We can finance ... https://www.lowermybills.com/learn/owning-a-home/how-to-refinance-with-bad-credit/

An FHA rate-and-term refinance lets you convert your mortgage into an FHA loan, with the goal of adjusting the interest rate and loan term. FHA ...

|

|---|